closed end loan disclosures

Of the disclosures you list here would be the status in a closed-end home equity loan. A closed-end loan is one in which the borrower receives a sum of money that they must repay by a certain date often in monthly installments.

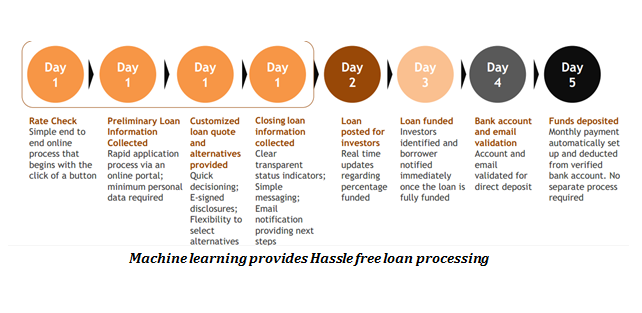

The Home Loan Process Broken Down Into Steps Home Improvement Loans Loans For Bad Credit Small Business Loans

102637 Content of disclosures for certain mortgage transactions Loan Estimate.

. Charges that are imposed as part of an open-end not home-secured plan and are not required to be disclosed under 10266 b 2 may be disclosed after account opening but before the consumer agrees to pay or becomes obligated to pay for the charge provided they are disclosed at a time and in a manner that a consumer would be likely to notice. 3 The information required to be disclosed under 102618 k l m and n. The lender and borrower reach an agreement on the amount borrowed the loan amount the interest rate and the monthly payment all of which are determined by the borrowers credit rating.

Private education loan disclosures 102647 Closed-End Credit Disclosure Forms Review Procedures. Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633. 5 The terms of repayment.

1 2015 will use the current Good Faith Estimate HUD-1 and Truth-in-Lending disclosures. Lately I have reviewed multiple closed-end loan advertisements with the same compliance issue not providing the required disclosures when a trigger term was present. 1 The amount or percentage of any downpayment.

Does the institution make all required disclosures clearly and conspicuously. Item Description Yes No NA. The value of a closed-end credit APR must be disclosed as a single rate only whether the loan has a single interest rate a variable interest rate a discounted variable interest rate or graduated payments based on separate interest rates step rates and it.

Prepared by Marjorie A. Trigger terms when advertising a closed-end loan include. Iii The effect of an increase.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by. Early TIL not applicable. All mortgage applications prior to Aug.

Home-equity lines of credit. RESPA does not require that any disclosures accompany the application form. 1 2015 will use the new Loan Estimate and Closing Disclosure.

Ii Any limitations on the increase. On July 30 2008 Congress enacted the Mortgage Disclosure Improvement Act of 2008 the MDIA. I The circumstances under which the rate may increase.

4 The annual percentage rate and if the rate may increase after consummation the following disclosures. Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling. 1 The unpaid balance of the obligation assumed.

Home mortgages and car loans are two common examples. 2 The total charges imposed by the creditor in connection with the assumption. The integrated mortgage disclosures apply to most consumer mortgages except.

4 The annual percentage rate originally imposed on the obligation. A servicer of a transaction subject to this section shall provide the consumer for each billing cycle a periodic statement meeting the requirements of paragraphs b c and d of this section. All applications received on or after Aug.

Regulation Z Section 2265ba1 If your home equity plan is closed-end Truth in Lending does not require any disclosures accompany the application form. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure. Obtaining a closed-end loan is an effective way for a borrower to.

The value of a closed-end credit APR must be disclosed as a single rate only whether the loan has a single interest rate a variable interest rate a discounted variable interest rate or graduated payments based on separate interest rates step rates and it. H Series of sales -. Institutions may provide disclosures required by 102624 opens new window to the consumer in electronic form without regard to consumer consent or other provisions of the E-Sign Act in.

1 The MDIA disclosures to be provided within three business days after an application is 1 The MDIA is contained in Sections 2501 through 2503 of the Housing and Economic Recovery Act of 2008 Public Law 110289 enacted on July 30 2008. Closed-End Credit Disclosure Forms Review Procedures Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID. The value of a closed-end credit APR must be disclosed as a single rate only whether the loan has a single interest rate a variable interest rate a discounted variable interest rate or graduated payments based on separate interest rates step rates and it.

A closed-end consumer credit transaction secured by a dwelling is referred to as a mortgage loan for purposes of this section. A creditor may include the detailed disclosure in the application form itself. By a Consumers Dwelling Appendix G to Part 1026 Open-End Model Forms and Clauses Appendix H to Part 1026 Closed-End Model Forms and Clauses Appendix I to Part.

You have to look at each requirement separately as they have different standards for applicability. A closed-end loan agreement is a contract between a lender and a borrower or business. 102624b opens new windowNote.

A trigger term is an advertised term that requires additional disclosures.

What Is A Closing Disclosure Finance Of America Mortgage

Home Equity Oak Tree Business Home Equity Equity Line Of Credit

Closing Disclosure Timelines The Three Day Rule

Home Equity Oak Tree Business Home Equity Equity Credit Union

Inquiry Training Model Science Science Lesson Plans Science Lessons Science Inquiry

What Is A Closing Disclosure Finance Of America Mortgage

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Credit Union

Home Equity Oak Tree Business Home Improvement Loans Refinance Mortgage Commercial Property

What Is A Closing Disclosure Finance Of America Mortgage

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

What Is A Closing Disclosure Quicken Loans

Home Oak Tree Business Credit Union Fourth Of July Business Systems

Understanding Finance Charges For Closed End Credit

Take A Look At The Altaone Specials For Rv Loans Are Those Lending Documents In Compliance Commercial Lending Credit Union Business Systems

Does Getting The Closing Disclosure Mean You Are Clear To Close Irrrl

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

:max_bytes(150000):strip_icc()/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)